What the heck is the difference between Samsung Pay and Android Pay?

If you own a newer model Samsung Galaxy smartphone, you might see that Android Pay and Samsung Pay are both available to you and seem to serve the same purpose, so what gives?

Android Pay and Samsung Pay are quite similar in that they both handle mobile payments. The user simply opens the payment application, takes a picture of a credit card to store its details, and uses the smartphone to pay for the transaction. However, the underlying technological differences between the two wireless mobile payment platforms could help one of them claim the leading position and make the other fall into obscurity.

Some Background on Mobile Payments

The recent boom in mobile payment options means that we could very soon leave our wallets at home and pay for everything with our smartphones. Gartner, an American research and advisory firm providing information technology-related insight, predicts that the global market for mobile payments will grow from about $235 billion in 2014 to $720 billion in transactions by 2017.

On Android, this amazing growth is entirely driven by two mobile payment options: Android Pay and Samsung Pay. Both arrived in September 2015 and have since established their firm place on the market with partnerships with countless financial institutions and retailers.

Android Pay

Right from the start, Google’s own mobile payment option, Android Pay, has one very important trick up its sleeve: It works on all smartphones with NFC and HCE (Host Card Emulation) support that are running Android 4.4 KitKat and later. Chances are that if you’ve recently bought an Android device from a leading smartphone manufacturer, you won’t have any problems getting Android Pay to work.

The number of supported devices will only grow in the future, as Google makes the requirements for Android Pay the new standard for all devices.

The biggest downside is it currently doesn’t support too many banks. You can find the official list of supported cards and banks on Android’s official website. At the time of writing this article, Android Pay should work with almost 700,000 store locations and 1,000 Android apps.

Samsung Pay

Samsung’s mobile payment platform is built upon a technology from a company called LoopPay, which was acquired by Samsung in 2015. According to their website, “LoopPay was born with the invention of Magnetic Secure Transmission (MST). This patented technology, along with the LoopPay app, became the most accepted mobile payment solution worldwide.”

MST emits a magnetic signal that mimics the magnetic strip on a traditional payment card, thus allowing for mobile payments at almost any point-of-sale system. Samsung claims that the technology is more secure than using a traditional payment card and is as secure as paying with Near Field Communication (NFC), which is what Google uses for their Android Pay system. Paying with MST through Samsung Pay is simple and intuitive: all users have to do is place their smartphone close to the terminal and wait for the system to confirm the payment.

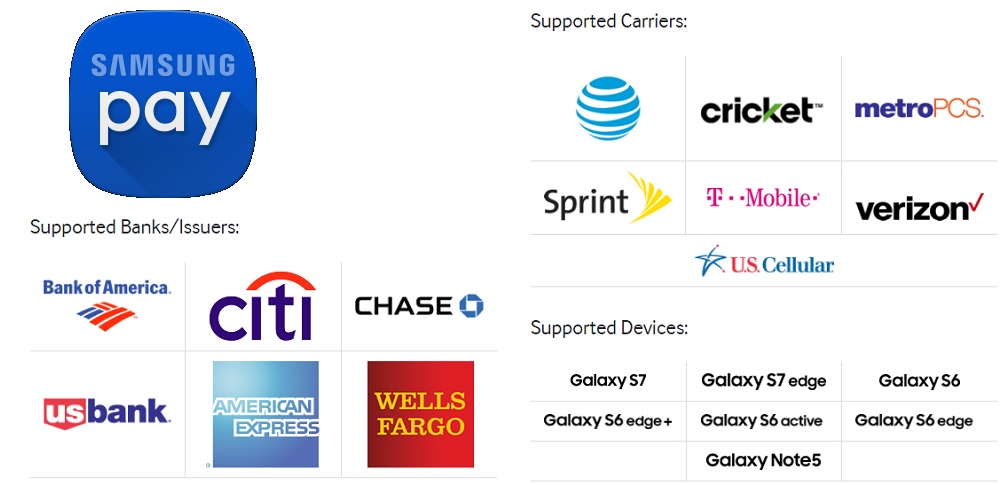

Because magnetic card terminals are much more widespread than those that accept NFC payments, it’s possible to use Samsung Pay in more than 90% of the stores in the United States and more than 30 million retail locations worldwide. Furthermore, with partnerships with over 100 financial institutions, you have much better chance of getting your card to work with the system than you do with Android Pay.

The MST technology was put to work in this recent Samsung Pay commercial:

All of this would perhaps make Samsung Pay the mobile payment system of choice for most customers, if it wasn’t for the limited device support. Currently, you can use Samsung Pay only with the Galaxy S6, S6 Edge, S6 Edge Plus, and Galaxy Note 5 – costly devices that completely leave out the mid- and low-end market.

Conclusion

The Samsung’s mobile payment system is heavily dependent on the quality and popularity of their smartphones. While they have a huge advantage today with the support for MST, this technology is likely to lose its relevance in the future, as NFC becomes the new norm. Android Pay relies on its army of third-party smartphone manufacturers to push the technology forward and bring it to customers across the world. Still, Google needs to ensure that the system will work flawlessly on all devices, otherwise it could gain a bad reputation.

MST makes all the difference.

It will take at least years before NFC has spread enough for satisfaction.

I have Samsung Pay, on my S7 edge, and my wife on her S7. It’s AMAZING! Yes, I couldn’t get my Mastercard loaded on it, so I currently use my CapOne card. No big deal. What is a BIG deal is that I can use Samsung Pay EVERYWHERE! What’s the point of Android Pay if it doesn’t work at 1/2 of the locations I visit? I’d still have to carry my wallet/card with me in most locations, because I don’t know if it will work or not. I’ve used Samsung Pay everywhere, and maybe 1 in 300 tries it didn’t work. It’s actually easier & better than physically having the original card, because of the delay when using a chip card. I go into big & small eateries, or even local shops, all of the time and I hold up my phone and they say “No we don’t take that.” I say “It’s okay”, hold my phone over the magnetic strip and they’re blown away. It really is AWESOME! I never even carry my wallet into places anymore. I love Google branded phones (loved my Nexus 5) and really want the Pixel 2, but to be honest Samsung Pay, with MST technology, is a GAME CHANGER! Doubt I’ll go back until either Android Pay gets MST or ALL shops everywhere finally get NFC machines.

Given how long Android pay has been available in one form or another, it’s a little late to be talking about it getting a bad reputation. Also, having recently gotten a Samsung phone and Samsung Pay, I switched back to using Android Pay after a couple of weeks.

While Samsung Pay and Android pay are functionally equivalent, Samsung has put too many friction points in, making it unpleasant to use. Android pay will just work – NFC picks it up, it does the transaction. You are unable to use Samsung pay without at least a fingerprint auth. This may be good security practice, but when you are trying to pay and go, it’s a friction point you don’t want. And as soon as a scan doesn’t go through and you have to re-auth, it has now become severe friction, and the average user will probably go back to using a card if they don’t know they can use Android Pay instead with less pain.

The MST thing was super cool and a great step to card-less payments – a year ago. I would argue it’s already just about lost a lot of relevance. Apple jumping on the NFC bandwagon has caused enough deployment of NFC in my experience that the advantage it confers has been greatly reduced. Instead, reduced friction when using it at POS is more important, and as I stated, Samsung has failed in that regard.

I added my Discover and Amazon cards with no issues.

I guess that list of supported banks / cards isn’t right. I’ve been using Android Pay for a couple years because Samsung Pay wouldn’t take my Discover. I thought I’d give it another try. First card I put in is my Chase Amazon Prime Visa card… “Not supported.” Oh well, Android Pay it is, haven’t found a card it doesn’t take yet.

Seems to be available pre-installed on Samsung A3 (2017) as well. It’s set up but not tested yet