Wendy’s Plans to Test Uber-Style ‘Surge Pricing’ for Menu Items in 2026

Wendy’s recently announced plans to roll out digital menu boards capable of adjusting prices dynamically throughout the day by 2025. The fast food chain will test demand-based pricing, similar to Uber’s surge pricing model. Under this system, menu items like burgers and fries would cost more during busy mealtimes and less during slower periods.

What is dynamic or surge pricing?

With dynamic pricing, businesses set variable prices that change continuously based on current demand. Rideshare services like Uber and Lyft are known for implementing “surge pricing” when demand spikes, increasing prices to incentivize more drivers to get on the road.

The idea is that prices go up when demand is high and down when demand is low. Uber’s algorithm takes into account factors like local traffic, number of ride requests, and driver availability when setting surge pricing.

The Corporate Perspective on Dynamic Pricing

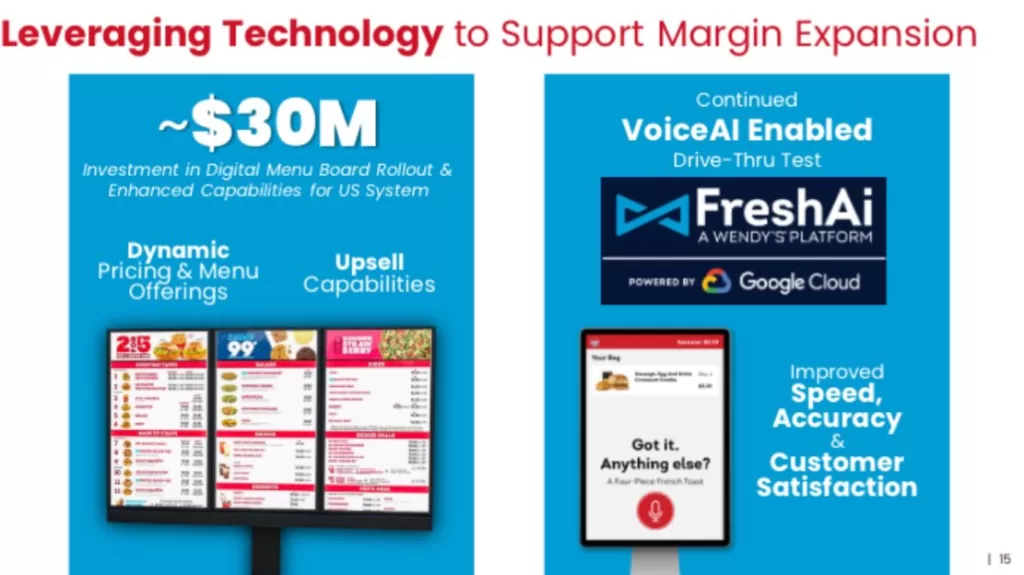

During the earnings call where CEO Kirk Tanner announced plans to test dynamic pricing, he also shared a slide from an investor presentation that sheds light on the corporate perspective behind this move.

The slide is titled “Leveraging Technology to Support Margin Expansion” and includes dynamic pricing as one of the key initiatives. Specifically, it states that Wendy’s plans to “leverage digital menu boards to enable consumer-facing technology and opportunities like dynamic pricing.”

This provides insight into how Wendy’s corporate leaders view dynamic pricing – namely as a way to expand profit margins. While surging prices during peak times could boost revenue, it remains to be seen how customers will respond. The slide’s jaargon-filled phrasing about “leveraging technology” shows how corporations try to spin dynamic pricing as an innovation rather than a price hike.

Wendy’s leaders believe the upside of higher margins outweighs potential backlash over perceived price gouging. Only time will tell if demanding customers embrace or reject pricing that fluctuates based on demand. But the investor slide makes clear that Wendy’s sees dynamic pricing as a useful tool for squeezing more profits out of its customers.

How could this impact Wendy’s customers?

Under a dynamic pricing model, Wendy’s would charge customers more for meals during breakfast, lunch and dinner rushes when restaurants are busiest. For example, a Baconator that costs $6 at 10am could jump to $7 at noon when demand spikes.

The amount of potential price fluctuation is unclear, but costs would be higher for customers who can only visit Wendy’s during traditional mealtimes. Retirees, shift workers without typical lunch breaks, and other diners with scheduling flexibility could potentially find deals during slower off-peak periods.

Why is Wendy’s considering this move?

The main goal is increasing revenue and profit margins. Wendy’s cited dynamic pricing as a key technological initiative for “margin expansion” in a recent investor presentation. The ability to nimbly adjust prices based on real-time demand signals offers opportunities to capture more consumer surplus.

Surge pricing allows companies to charge the maximum price customers are willing to pay during periods of peak demand. While risky if seen as price gouging, dynamic pricing could boost Wendy’s bottom line if customers embrace the practice.

How will Wendy’s implement surge pricing?

Wendy’s plans to invest $20 million to install digital menu boards capable of changing prices easily across all US locations by the end of 2025. No heavy lifting for employees.

The menu boards will leverage AI and algorithms to continuously update pricing. Wendy’s cited the technology’s ability to enable “opportunities like dynamic pricing” in its earnings call.

What are the risks of dynamic pricing for Wendy’s?

Consumer backlash is a real danger if customers perceive surging prices as unfair price gouging. A survey found 52% of consumers equate dynamic pricing with price gouging. Wendy’s risks alienating budget-conscious diners.

Operationally, the complex software required to change prices dynamically could also prove costly or difficult to implement smoothly across thousands of locations.

Will other fast food chains follow?

A few fast casual chains have tested limited dynamic pricing models with some success. But Wendy’s is the first major national fast food player to announce plans for demand-based pricing.

If its upcoming pilot works well, competitors like McDonald’s and Burger King could jump on the bandwagon. Uber’s model has already expanded across the transportation industry, showing how dynamic pricing can spread once adopted.

Wendy’s said it will begin testing in 2026. It remains to be seen if consumers are ready to accept surge pricing when it comes to cheeseburgers and fries. But for now, be prepared to pay a little more for your Frosty during peak hours once dynamic pricing expands beyond Uber.

Вь