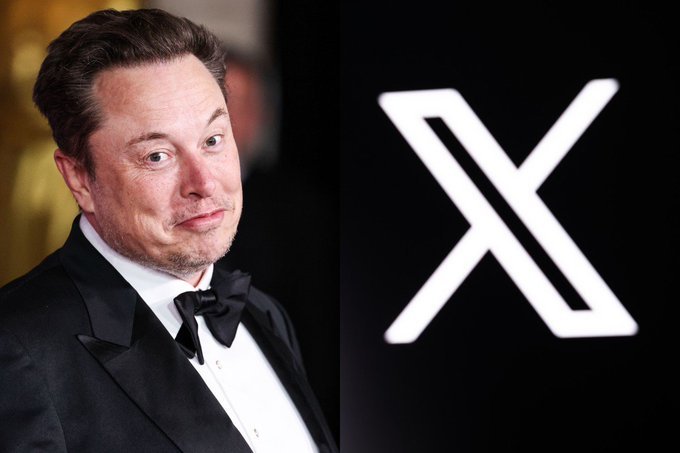

The Real Reason Elon Musk Bought Twitter for $44B

In 2002, Elon Musk exited the financial scene after selling PayPal for $1.5 billion, seemingly stepping away from the industry. However, his recent partnership with Visa to integrate payments into X marks a bold return, revealing a deeper strategy behind his $44 billion acquisition of Twitter.

The Genesis of Elon’s Vision

Back in 2002, after selling PayPal for $1.5 billion, Elon Musk vanished from the finance scene. However, his ambition to innovate in the digital space never waned. Fast forward to 2025, and we see Musk partnering with Visa to bring payments directly to the platform X, a move that underscores the real reason behind his $44 billion acquisition of Twitter. This partnership is not just a financial maneuver; it’s a pivotal step in Phase 2 of Elon’s grand vision for X.

The Announcement: A New Era of Digital Finance

The journey began with the announcement from CEO Linda Yaccarino of a groundbreaking partnership with Visa. The goal? To introduce the X Money Account – a digital wallet powered by Visa Direct. This isn’t merely about adding another payment app to the market; it’s about creating a foundation for something much larger.

More Than Just a Payment App

This initiative is the next step in Elon’s master plan to create an “everything app” akin to China’s WeChat. Imagine a single platform where you can:

- Chat with friends

- Pay for goods and services

- Transfer money effortlessly

- Shop online with ease

And this is just the beginning. The ambition is to integrate all aspects of daily digital life into one seamless experience.

The Power of Visa Direct

The X Money Account will leverage Visa Direct for:

- Real-time payments

- Peer-to-peer transfers

- Bank account connections

- Secure digital wallet storage

This integration with Visa Direct sets X apart from other payment apps by enabling instant transactions, which is a game-changer in user experience.

A Massive Built-In User Base

With 51.8 million U.S. users already on X, the platform has a colossal built-in user base, something many fintech startups can only dream of achieving. The integration of social media with financial services means sending money could be as straightforward as sending a tweet. This synergy between social interaction and finance opens up fascinating possibilities.

A History of Fintech Innovation

This isn’t Elon’s first venture into fintech. In 1999, he co-founded X.com, one of the world’s first online banks. X.com later merged with Confinity to become PayPal, which was sold to eBay for $1.5 billion. Now, 25 years later, Elon is revisiting this space, aiming to connect his past innovations with future aspirations.

Regulatory Milestones

X has already made significant strides in regulatory compliance, securing money transmitter licenses in 38 U.S. states. This careful approach to regulation is building trust with both regulators and users, ensuring a smooth rollout of financial services.

A New Approach to Financial Integration

Rather than directly competing with established services like PayPal or Venmo, X is pioneering a new model where social media seamlessly integrates with finance. Think about:

- Tipping creators instantly

- Splitting bills with friends

- Purchasing products directly from posts

The possibilities are endless, and they’re just starting to unfold.

Game-Changing for Content Creators

For content creators, this integration is revolutionary:

- Seamless monetization of content

- Direct tipping from followers

- Built-in subscription payments

- Instant payouts

No more waiting for days for payments to process, giving creators a more immediate and direct connection with their audience.

The Future of Money on X

Looking ahead, the potential is staggering:

- Integration with cryptocurrencies

- High-yield money market accounts

- Direct e-commerce integration

- Efficient international transfers

X isn’t just building a payment system; it’s crafting the future of how we interact with money on a global scale.

Blurring Lines Between Social Media and Business

The partnership with Visa highlights a crucial shift: the line between social media and business is disappearing. If you’re not creating on X, you’re missing out on a massive opportunity. This platform is poised to become the epicenter of internet commerce.

Building Your Brand on X

As X evolves into this everything app, early adopters will reap substantial benefits. The question for individuals and businesses alike is whether to build your brand now on X, or to watch others seize this opportunity.

Building a personal or company brand on X represents the best opportunity of this generation. It’s like real estate for the digital age: you either consume content and pay with your attention, or you create and build a following, which becomes an asset that pays dividends for life. The choice is clear: embrace the evolution of X and be part of shaping the future of digital interaction and finance.

Lol, the primary reason he bought twitter was because of a spat he got into with the guy posting the whereabouts of his jet. Elon asked him to take it down and the guy said pay me $5000 and I will. Elon sperged out and bought twitter so he could shut the guy’s account off without paying him.