PayPal’s $4B Honey Acquisition Under Scrutiny: Former Competitor Reveals Industry’s Open Secret

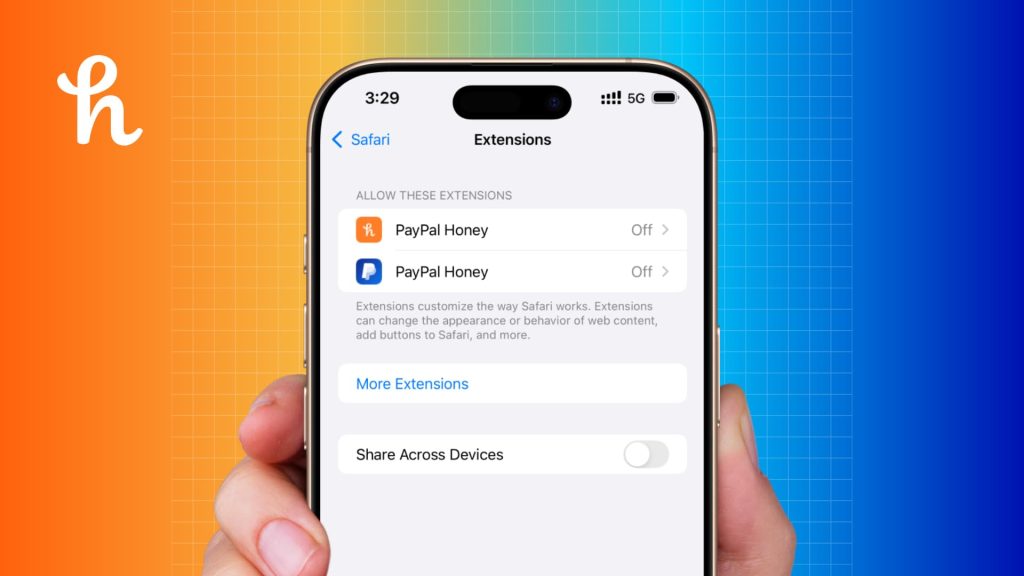

In a revealing insider account, a former startup executive has shed light on the controversial business practices of Honey, the popular coupon-finding browser extension acquired by PayPal for $4 billion. The disclosure comes in response to recent criticism from prominent tech reviewer MKBHD (Marques Brownlee), who questioned Honey’s business model and practices.

A recent video by popular tech YouTuber MKBHD has sparked a debate about the business practices of Honey, a well-known browser extension for finding and applying coupon codes during online shopping. The controversy has brought to light long-standing questions about the affiliate marketing industry and the value proposition of coupon extensions to retailers.

The Allegations

MKBHD’s video raised two main concerns about Honey’s operations:

- Commission Hijacking: Honey allegedly “steals” commissions from other affiliate partners by placing its cookie last during the checkout process, effectively claiming credit for sales it didn’t initiate.

- Questionable Value to Retailers: The extension’s core benefit to retailers is called into question, as it provides discounts to customers who were already prepared to make a purchase at full price.

Industry Insider Perspective

A former competitor to Honey has shared insights into the affiliate marketing landscape, revealing that these practices have been prevalent for years. Key points from their experience include:

- Affiliate Marketing Evolution: The industry began in the early to mid-1990s as a way for content publishers to earn commissions by referring customers to online retailers.

- Retailer Adoption: As affiliate marketing grew, retailers hired dedicated managers and teams, allocating significant budgets to these initiatives.

- Coupon Extension Mechanics: These extensions typically activate on checkout pages, applying affiliate links or cookies to claim commission for sales.

The Retailer Dilemma

The insider suggests that retailers’ acceptance of coupon extensions like Honey may be due to:

- Misaligned Incentives: Affiliate marketing teams are often encouraged to spend their entire budgets, potentially prioritizing new channels over ROI.

- Lack of Scrutiny: Very few retailers reportedly challenged the claim that coupon extensions increase conversion rates.

- Brand Appeal: Honey’s strong brand and user growth likely made it an attractive partner for retailers.

Industry Implications

This controversy raises several questions about the future of affiliate marketing and coupon extensions:

- Transparency: Will retailers demand more data-driven evidence of value from coupon extensions?

- Affiliate Attribution: How might the industry address concerns about commission attribution?

- Consumer Trust: How will this revelation affect user perception of coupon extensions?

According to the insider, who led a team building a direct competitor to Honey in 2016, the industry’s questionable practices were well-known long before MKBHD’s recent exposé. The primary concerns center around two key issues: commission attribution manipulation and the dubious value proposition to retailers.

The foundation of the controversy lies in the mechanics of affiliate marketing, a system designed to reward content creators and publishers for directing new customers to retailers. However, the insider reveals that coupon extensions like Honey essentially intercept existing sales at the final checkout stage, claiming commissions for customers who were already committed to purchasing.

What makes this particularly interesting is the apparent lack of due diligence from retailers. According to the insider, out of thousands of e-commerce partners, only one retailer – a small farm equipment reseller – ever requested data to verify if the coupon-finding service actually increased conversion rates as claimed.

The insider attributes this oversight to misaligned incentives within retail organizations. Affiliate marketing managers, armed with substantial budgets and pressured to spend them, were more focused on discovering trendy new channels than validating their effectiveness. Honey, with its strong brand presence and user growth, capitalized on this dynamic.

“In short: bad incentives, and incompetence,” the insider explains, noting that their own company’s business pitch essentially amounted to: “You’re already paying Honey for it; why not pay us too?”

The revelation is particularly timely given Honey’s massive $4 billion acquisition by PayPal. The insider expresses amazement that practices they believed would be quickly exposed in 2016 not only persisted but led to such a significant exit. This raises questions about the sustainability of current affiliate marketing practices and the need for greater scrutiny in the e-commerce ecosystem.

The story serves as a cautionary tale about the sometimes murky intersection of technology, marketing, and e-commerce, where innovation can blur the line between adding value and exploiting system loopholes. It also highlights how corporate incentive structures can perpetuate questionable practices, even when they appear obvious to industry insiders.

In the wake of these revelations, the e-commerce industry may face increased pressure to reevaluate its affiliate marketing practices and implement more rigorous validation of value propositions from technology partners.

Give credit the original video by Megalad instead of the video reacting to Megalad’s investigation