Waymo’s Market Share Is Now Equal to Lyft In San Francisco

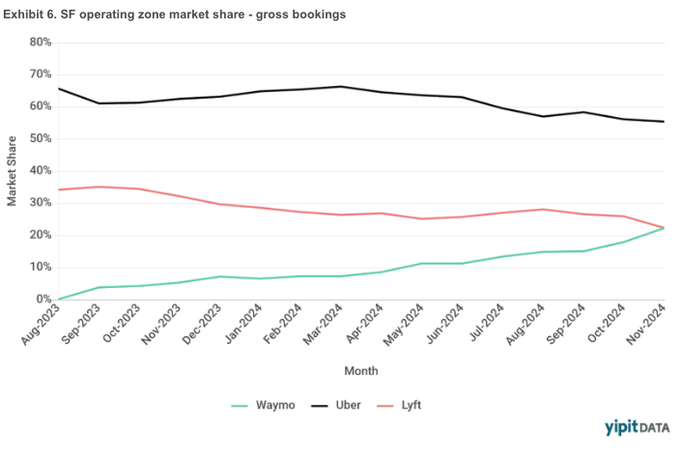

Waymo’s rapid ascent in the ridesharing market, particularly in San Francisco, signals a significant shift in the landscape of autonomous vehicle services. As of November 2024, Waymo’s market share has surged to equal that of Lyft at 22%, while Uber maintains a leading position with 55%.

This represents a dramatic change from August 2023, when Uber and Lyft commanded 66% and 34% of the market, respectively. Over the past 15 months, both Uber and Lyft have experienced a decline in market share, with Lyft losing about one-third of its share compared to Uber’s one-sixth loss. This trend raises critical questions about the future of ridesharing and the role of autonomous vehicles.

The Role of Network Effects

Network effects are often touted as a key source of defensibility in tech markets. However, their importance in ridesharing appears limited. While a minimum network size is necessary to ensure reasonable wait times for riders, the benefits diminish once that threshold is met.

In practice, Uber and Lyft require enough drivers to maintain acceptable wait times; once these are achieved, typically around 2-4 minutes, the incremental addition of drivers does little to enhance the rider experience. As one user noted, “If my Uber ride is coming in 2-4 minutes, I don’t really care about the wait times getting faster.”

Waymo’s Competitive Edge

Despite anecdotal evidence suggesting that Waymo’s wait times are longer than those of its competitors due to a smaller fleet, the quality of service provided by Waymo has begun to sway riders in its favor.

Users have praised the experience as significantly better than traditional ridesharing options: “A private car that doesn’t mind waiting, shows up on time, never cancels on you, drives extremely safe, and doesn’t want a tip,” remarked one satisfied rider.

This sentiment is echoed by others who appreciate the privacy and comfort offered by Waymo vehicles compared to human drivers.

Waymo’s strategy hinges on scaling its fleet effectively. As it increases the number of cars on the road and reduces wait times to match those of Uber and Lyft, its market share could grow even faster. However, this raises questions about operational efficiency, specifically whether Waymo should build its fleet to average load or peak demand.

Market Dynamics and Future Growth

The current ridesharing market represents only 1% of total vehicle miles traveled. Waymo’s ability to reduce operational costs through automation positions it well for future growth. As costs decrease, Waymo can offer cheaper rides while maintaining safety standards, thereby increasing demand.

One user pointed out that “having to deal with awkward and uncooperative humans is a huge minus” after experiencing Waymo rides. This highlights a potential shift in consumer preferences towards autonomous services that offer consistent quality without human interaction.

However, challenges remain regarding adoption rates outside tech-centric areas like San Francisco. Concerns about safety and reliability persist among potential users who may be hesitant to embrace fully autonomous vehicles for family use. As one commenter expressed doubt about broader adoption: “I’m not riding one with my toddler.”

The Impact of Pricing and Quality

While pricing is often considered a critical factor in consumer choice, many riders seem willing to pay a premium for the superior experience offered by Waymo. Users have noted that “there’s basically no price advantage” compared to traditional ridesharing but prefer not having a driver present for reasons ranging from comfort to perceived safety.

As noted by industry observers, “Waymo doesn’t wear cologne,” emphasizing the appeal of an odor-free environment free from human quirks that can detract from the ride experience.

Waymo’s Rising Ridesharing Market Share

Waymo’s emergence as a formidable player in the ridesharing market reflects broader trends toward automation and changing consumer preferences. The company’s ability to leverage technology for operational efficiency while providing a high-quality user experience could pave the way for further growth. However, it must navigate challenges related to fleet management and consumer acceptance outside urban centers.

As we look ahead, it’s clear that Waymo’s journey is just beginning. With significant investments from Alphabet Inc., ongoing technological advancements, and expanding service areas, Waymo is poised to redefine transportation in ways we are only beginning to understand. The future may indeed be driverless, but it will also be defined by how well these services can adapt to meet diverse consumer needs across varying contexts.