Trump’s Tariff Gambit Just Made iPhones 54% More Expensive: An American Liz Truss Moment in the Making

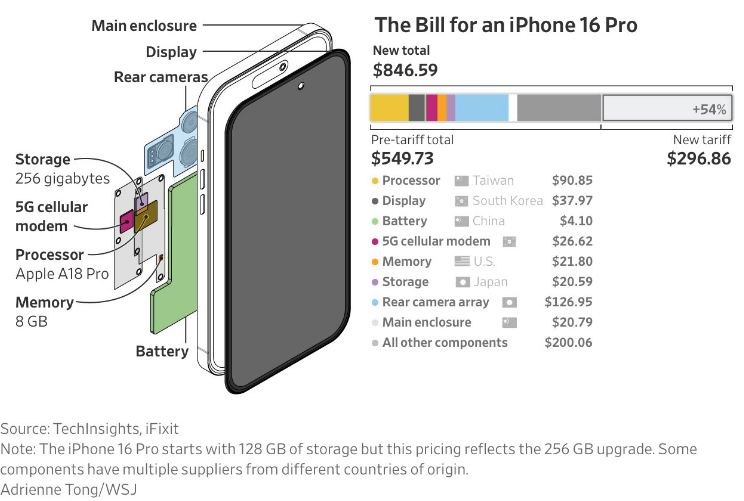

In a move reminiscent of economic shock therapy, Donald Trump’s proposed trade policy has effectively slapped a 54% tariff on the cost of building an iPhone 16 Pro, pushing its total production cost from $549.73 to a staggering $846.59. The Wall Street Journal graphic breaking down the impact shows it clearly: nearly $300 has been added in tariffs alone, an extraordinary surge for a single consumer item and a symbolic warning flare for globalized supply chains.

This isn’t a theoretical impact, it’s a hard dollar shift with real implications. The iPhone, perhaps the most visible consumer product on the planet and the pride of U.S. design innovation, is also a masterclass in international collaboration. Its processor comes from Taiwan, its display from South Korea, its battery from China, memory from the U.S., cameras and enclosures from various global vendors. Trump’s tariffs hit virtually every node of that supply chain.

Let’s be clear: this isn’t just an Apple story. It’s a message to every U.S. company that relies on an international production model. From microchips to sneakers, this kind of across-the-board tariff imposition isn’t targeted economic nationalism, it’s a blanket tax on the American consumer and a gut punch to business predictability.

A 54% Surge: Why It Matters

- Pre-tariff cost of production: $549.73

- New tariff cost added: $296.86

- Total new cost: $846.59

- % Increase: +54%

That type of hike is catastrophic for product pricing. Either Apple eats that cost and sees profit margins gutted, or it passes it directly to consumers. Either way, it triggers a negative domino effect: inflationary pressure, reduced demand, competitive disadvantage, and a chilling effect on future investment in U.S.-based design innovation.

The Liz Truss Comparison

This is where the Liz Truss analogy starts to make sense. Truss, the short-lived UK Prime Minister, proposed an unfunded, aggressive economic policy package that spooked markets and tanked the pound in days. Trump’s move here isn’t a tax cut, but the sudden imposition of economic weight on a globally linked system. It similarly ignores market realities. And just like in the Truss episode, the damage begins not with implementation, but with expectation.

Markets don’t wait for tariffs to be signed into law to respond. Investors, procurement teams, and consumers are already reacting. If this policy direction sticks, there’s no path where a $1,200 iPhone doesn’t become a $1,600 iPhone overnight. That’s not just unsustainable. It’s politically suicidal.

The Political Theater vs. Economic Reality

Yes, there’s a populist appeal to “bringing production back home.” But the fantasy that tariffs will force Apple to suddenly build iPhones entirely in the U.S. ignores decades of supply chain development, specialized labor, and component economies built overseas. Manufacturing an iPhone domestically would take years to ramp up and would still likely cost significantly more.

This isn’t protectionism with a plan, it’s economic nationalism as performance art.

What Happens Next?

The most likely outcome is retreat. Like Truss, Trump could be forced into an embarrassing walk-back under pressure from markets, businesses, and even his own allies. The math simply doesn’t hold. It’s unsustainable, and he knows it.

But in the meantime, it’s an object lesson in what happens when global supply chains meet political theater. The iPhone, the very symbol of modern American ingenuity, may now become its most expensive political football.

And as the price tag ticks up, American consumers may realize: slogans don’t make smartphones. Supply chains do.