Tesla CEO Elon Musk Rejects Uber CEO’s Call For Multi-Sensor Self-Driving, Says LiDAR and Radar Create Safety Risks

The clash over how to safely achieve fully autonomous vehicles reignited this week, with Tesla’s Elon Musk and Uber’s Dara Khosrowshahi presenting sharply opposing views. At the heart of the debate is whether more sensors improve safety, or if simpler, camera-based systems offer a safer and more scalable path forward.

Uber makes the case for multi-sensor autonomy

On a recent podcast, Uber CEO Dara Khosrowshahi argued that camera-only systems are not ready to reach superhuman levels of safety. He highlighted Alphabet’s Waymo as evidence that combining LiDAR, radar, and cameras delivers results today. According to him, all of Uber’s partners rely on multiple sensors, and this approach is the most reliable path for the industry right now.

“In the near term, it’s going to be very difficult , and Elon would tell me I’m wrong , to build a camera-only product that has superhuman levels of safety,” Khosrowshahi said. He added that camera-based systems may eventually achieve that level but insisted that right now, redundancy matters.

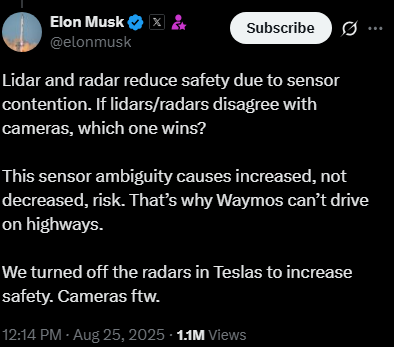

Musk doubles down on vision-only

Musk quickly rejected the claim. Posting on X, he argued that LiDAR and radar actually reduce safety due to conflicting signals. “Lidar and radar reduce safety due to sensor contention. If lidars/radars disagree with cameras, which one wins? This sensor ambiguity causes increased, not decreased, risk. That’s why Waymos can’t drive on highways,” he wrote.

Tesla has already removed radar from its vehicles, relying exclusively on advanced computer vision systems. Musk has repeatedly called LiDAR “lame,” “stupid,” and a “fool’s errand,” claiming cameras mirror the way humans perceive the world and will ultimately prove cheaper and more effective.

Waymo’s track record challenges Musk

Despite Musk’s dismissal, Waymo’s safety data has given credibility to the multi-sensor approach. By March 2025, Waymo had logged 71 million rider-only miles without a human driver. Crash rates were 88 percent lower than human averages, with just two serious incidents compared to 17 for human drivers across the same mileage. Those numbers fuel the argument that sensor redundancy delivers measurable results in real-world driving.

Uber’s autonomous expansion

Uber is not standing still. The company recently announced deals with Lucid Group and Nuro to put more than 20,000 robotaxis on the road within six years. Customers in Atlanta can already book Waymo robotaxis through Uber’s platform, and the company is sweetening the transition to electric vehicles by offering up to $2,000 in benefits for Colorado drivers who switch to EVs.

These moves underscore Uber’s commitment to pairing electrification with autonomy, while leaning heavily on proven sensor combinations rather than Musk’s purist vision-based approach.

Tesla under scrutiny

Tesla, meanwhile, is fighting legal and regulatory headwinds. Customers and investors have filed lawsuits alleging that its Full Self-Driving system was marketed with exaggerated claims and insufficient safety disclosures. The NHTSA has also raised concerns about delayed crash reporting.

Former Waymo CEO John Krafcik went further, arguing Tesla’s vehicles cannot be called “truly driverless” if they still require safety drivers. Yet Tesla continues to expand, even posting job listings for robotaxi test drivers in New York City.

Market and sentiment split

The market has reacted unevenly to the two strategies. Tesla’s stock has dropped 16 percent so far in 2026, reflecting growing concerns about FSD setbacks and regulatory risks. Uber shares, by contrast, are up more than 60 percent, with investors rewarding its measured but visible progress in both autonomy and electrification.

On Stocktwits, retail sentiment was bearish toward Tesla and neutral toward Uber, though message volume remained relatively low.

A clash of philosophies

This debate is about more than just sensors. It’s a battle between two competing philosophies: whether building systems that mimic human vision alone will scale best, or whether engineering redundancy into cars ensures safety faster.

Waymo and Uber are betting on layered sensor suites, while Tesla remains committed to vision-only autonomy. Each side has compelling arguments, but the true test will come on public roads, where regulators, investors, and everyday passengers decide which path defines the future of driverless transportation.