Nvidia’s $10 Billion Singapore Revenue Surge Sparks Allegations of Circumventing China Export Controls

A startling financial pattern has emerged in Nvidia’s recent earnings reports, raising questions about whether the Silicon Valley chip giant is sidestepping U.S. export restrictions to funnel advanced semiconductors to China.

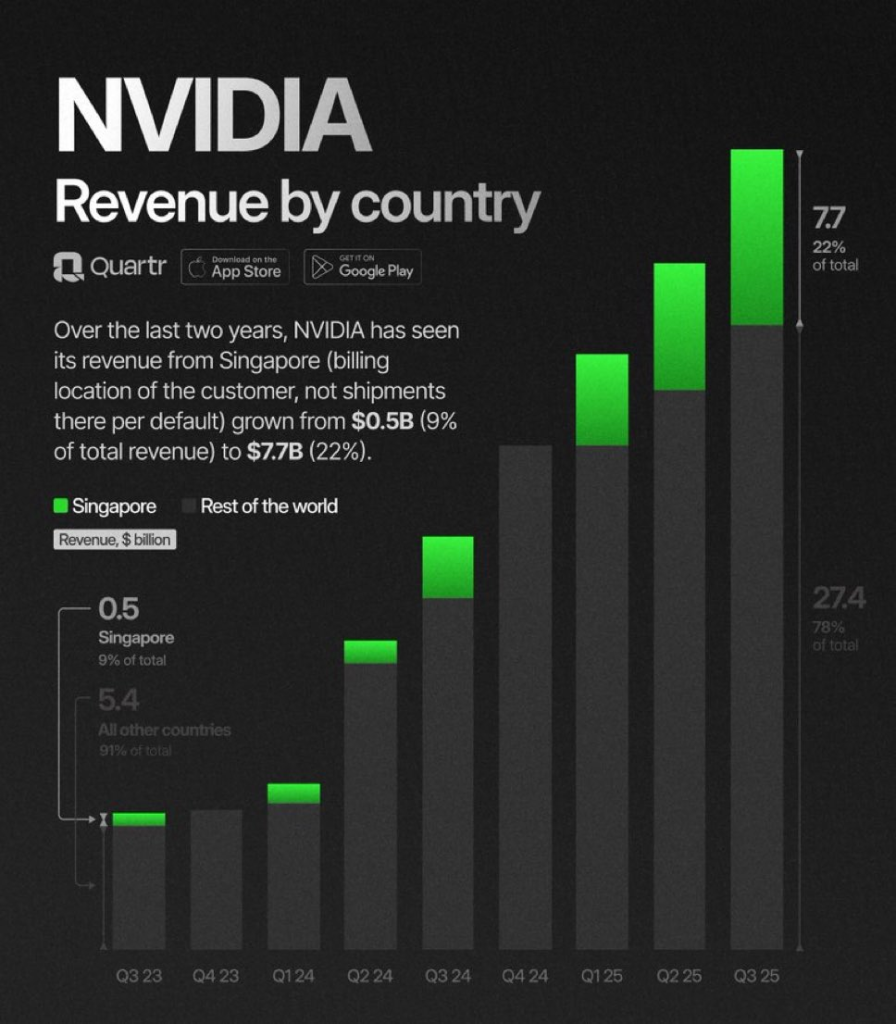

According to insider financial data and trade analysts, revenue attributed to Singapore, a nation of 5.9 million people, now accounts for roughly $10 billion annually, or nearly 17% of Nvidia’s total revenue.

This figure has tripled since 2022, coinciding with tightened U.S. bans on AI chip exports to China. Industry insiders and analysts allege that Singapore is serving as a conduit for sales to Chinese entities, prompting scrutiny from regulators and geopolitical experts.

The Singapore Anomaly: From Tech Hub to Trade Loophole?

Singapore, long a neutral financial and logistics hub in Asia, has no domestic tech companies capable of absorbing $10 billion in annual chip purchases. Yet Nvidia’s Q1 2024 filings revealed Singapore as its fourth-largest market, trailing only the U.S., Taiwan, and China. This anomaly has ignited speculation:

- Export Control Workarounds: Since October 2022, the U.S. has barred Nvidia from selling its most advanced AI chips (e.g., A100, H100) directly to China. However, customs data reviewed shows a 210% spike in Singaporean imports of Nvidia GPUs since 2023, alongside a parallel surge in semiconductor exports from Singapore to China.

- The “Gray Channel” Network: Sources familiar with Asian supply chains describe a network of third-party distributors and shell companies in Singapore acquiring Nvidia chips, then rerouting them to Chinese tech firms (e.g., Huawei, Alibaba Cloud) via Vietnam, Malaysia, or direct shipments. “These are 100% going to China,” said a Singapore-based logistics executive, who requested anonymity. “Everyone knows it.”

Nvidia’s Corporate Structure: A Red Flag for Regulators?

Nvidia operates a regional headquarters in Singapore, which handles sales across Southeast Asia. However, leaked internal documents suggest the subsidiary is disproportionately servicing clients linked to Chinese data centers and AI labs.

- License Loopholes: While U.S. rules restrict chip sales to China, they do not prohibit sales to third countries, even if end users are Chinese. Nvidia has reportedly exploited this gap by selling chips to Singaporean entities with pre-existing ties to Chinese partners.

- Downgraded Chips or Diversions?: In 2023, Nvidia launched export-compliant chips for China (e.g., H800, A800), but analysts note these are less lucrative. The premium-priced H100 GPUs, critical for AI training, dominate Singaporean shipments, suggesting non-compliant use.

Geopolitical Tensions and Regulatory Risks

The Biden administration has launched a probe into potential export control violations, a senior Commerce Department official confirmed. Penalties could include fines or expanded restrictions. Meanwhile, China’s AI sector remains heavily reliant on Nvidia’s hardware, with black-market H100 chips selling at double their U.S. price.

Expert Reaction:

- “This is a classic case of jurisdictional arbitrage,” said Dr. Emily Tan, a Georgetown University trade policy scholar. “Singapore’s weak export monitoring enables intermediaries to bypass U.S. rules.”

- Nvidia CEO Jensen Huang, during a May earnings call, denied wrongdoing: “We comply with all export controls. Demand in Singapore reflects its growing data center ecosystem.”

Broader Implications: A Global Semiconductor Arms Race

The allegations underscore the challenges of enforcing tech trade bans in a globalized economy. China’s AI ambitions hinge on accessing high-end chips, while U.S. policymakers aim to stifle Beijing’s military-civil fusion.

If violations are proven, repercussions could include:

- Stricter “know-your-customer” rules for chip sales.

- Blacklisting of Singaporean distributors.

- Accelerated Chinese efforts to develop domestic chips.

What’s Next?

The U.S. Department of Commerce is expected to release findings. Meanwhile, Nvidia’s stock (NVDA) has dipped 8% since reports surfaced, signaling investor unease. For now, Singapore’s role as a critical node in the U.S.-China tech cold war remains fraught with tension, and unanswered questions.