Mark Zuckerberg’s Bold Bet on the Metaverse

In a world where technology evolves at breakneck speed, Mark Zuckerberg’s vision for Meta, formerly known as Facebook, stands out as one of the most audacious corporate gambles in recent history.

Zuckerberg has invested $16 billion annually into building a virtual world, known as the metaverse, that many are skeptical about. This investment has stirred fury among investors and skepticism on Wall Street, yet Zuckerberg believes he might be making the smartest bet of the century.

Here’s why this gamble is so significant.

The Rebranding of Facebook to Meta

In October 2021, Mark Zuckerberg made a historic decision by rebranding Facebook to Meta, signaling a full commitment to the future of virtual reality (VR). This move was not just a name change but a declaration of intent to pivot the entire company’s future around this new technology. The rebranding reshaped the future of technology, setting the stage for what could potentially be a new era in digital interaction.

The Race for Virtual Reality Supremacy

The official reason for the rebranding was to position Meta at the forefront of what Zuckerberg described as “the next frontier” – the metaverse. However, beneath this was a strategic battle for control over the next generation of computing. Meta was not alone in this ambition; tech giants like Apple, Microsoft, and others were also eyeing the lucrative VR space, each with their visions of what the future of computing could look like.

The Financial Stakes

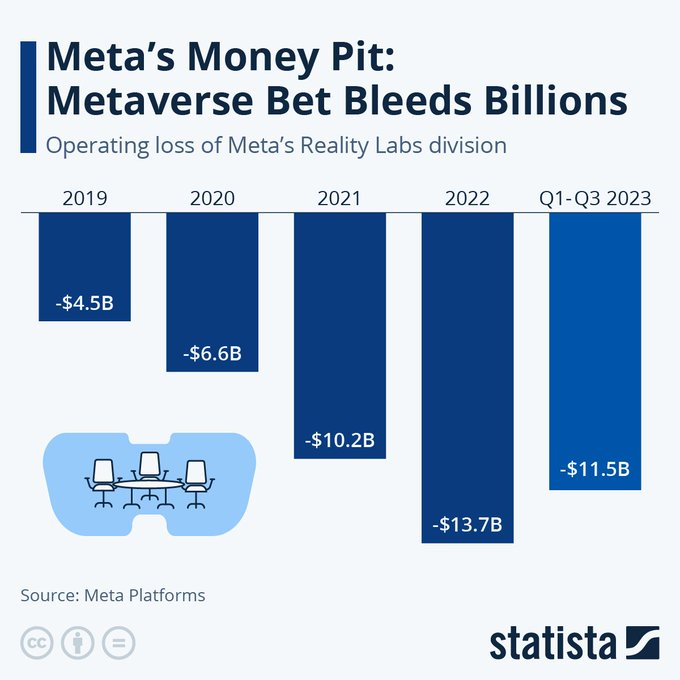

Despite the skepticism, Zuckerberg’s response has been to double down on this vision. Reality Labs, Meta’s division dedicated to the metaverse, has been burning cash at an unprecedented rate.

In 2023 alone, it reported a staggering loss of $16.1 billion. To put this into perspective, this amount could have bought Netflix in 2009 or funded 160 blockbuster movies. Over the years, Meta has poured over $50 billion into Reality Labs, surpassing the GDP of 90 countries and even exceeding the total cost of the Apollo space program when adjusted for inflation.

The Connect Conference Vision

At the Connect conference in 2026, Zuckerberg made it clear that this venture was beyond enhancing social networks; it was about crafting the future of human interaction. He was prepared to invest more significantly than any other company in this endeavor, not just for technological advancement but for legacy.

Market Strategy and Consumer Adoption

While competitors like Apple opted for high-end, expensive VR headsets like the $3,499 Vision Pro, Zuckerberg took a different approach with the Quest 3, priced at a more accessible $499. This was a strategy aimed at mass market adoption without compromising on the commitment to VR technology. However, this strategy led to a plummet in Meta’s stock price, with Wall Street analysts criticizing the spend as “burning money on science projects.”

Technological Challenges

Despite the investment, one major issue persisted: the technology was not yet ready for prime time. VR headsets were still bulky with limited battery life, and the metaverse itself felt underpopulated and somewhat hollow. Yet, Zuckerberg’s persistence was driven by a vision of social connection transcending beyond text and photos, into immersive, virtual experiences.

The Potential of the Metaverse

Every shift in computing platforms has historically created new tech giants. From PCs making Microsoft, to mobile elevating Apple, and social media crowning Facebook/Meta, the metaverse could potentially dwarf these transformations.

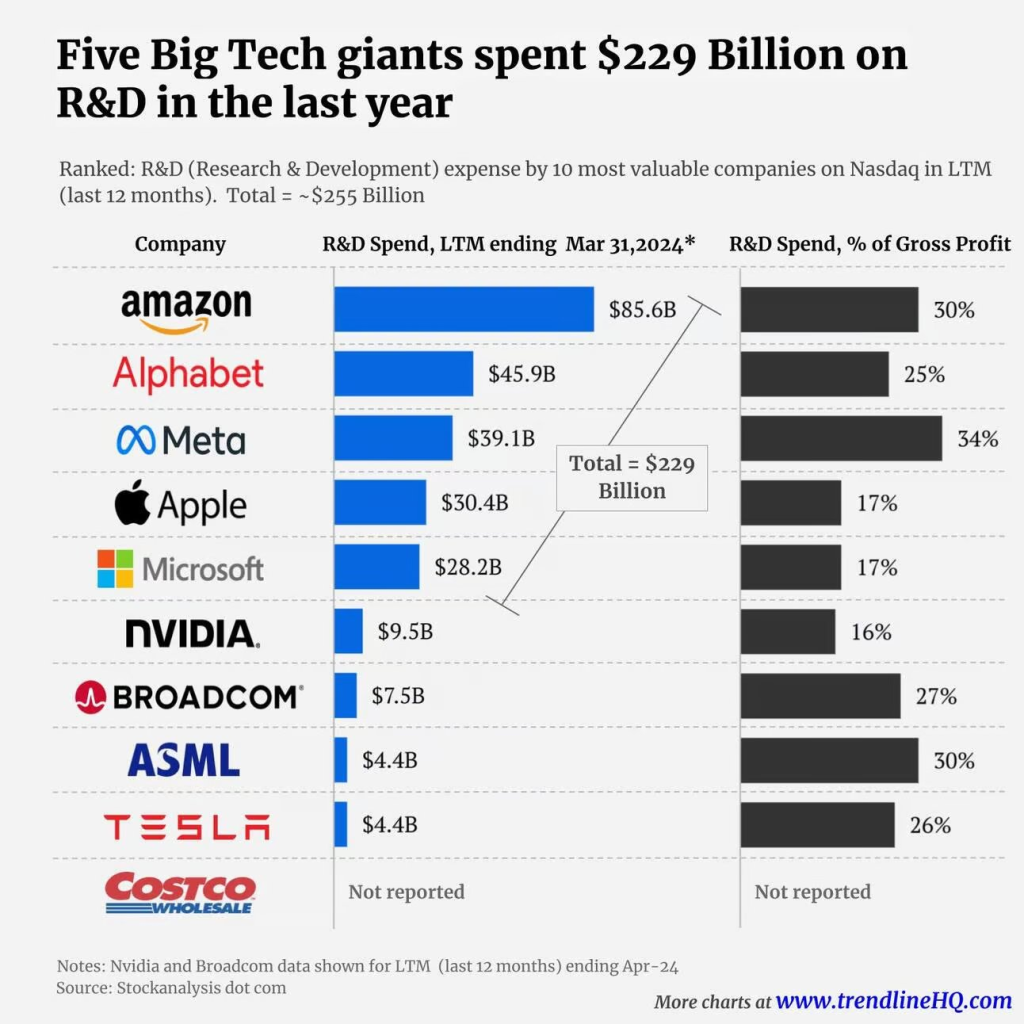

With Meta spending $229 billion on R&D in the last year, more than any private company in history, and competing against the world’s most valuable companies, Zuckerberg’s bet is against conventional wisdom.

Financial Power and Control

Zuckerberg’s strategy is underpinned by Meta’s vast user base of 3 billion monthly active users across its apps, which acts as a cash-generating machine. This financial strength allows for such an unprecedented gamble.

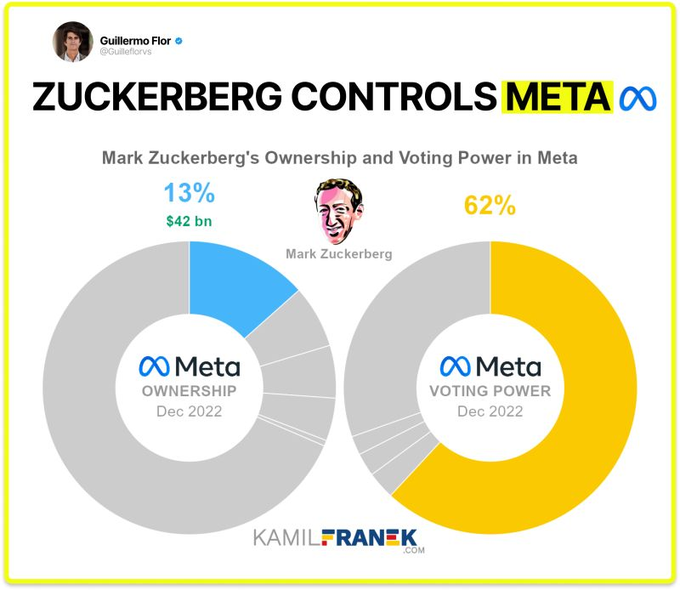

Additionally, Zuckerberg’s control over Meta through dual-class shares gives him the power to invest against Wall Street’s advice, pursue long-term visions, and withstand short-term market pressures, with $50 billion spent so far and Reality Labs still in the red.

The Metaverse Wars

The question isn’t whether Meta will succeed with the metaverse, but if anyone can afford to compete with a company willing to spend unlimited resources on this dream. In an era where CEOs often play it safe, Zuckerberg’s gamble is monumental, using real money and not just corporate promises.

Time will tell if this is visionary or the costliest corporate mistake, but the scale of this gamble ensures it will be studied in business schools for decades. Welcome to the metaverse wars, where Zuckerberg is all in.