Ken Fisher and the Google Ads Strategy That Built a $236 Billion Empire

In 2023, one wealth management firm made a bold move that left its competitors scratching their heads. While others hesitated, Fisher Investments spent a staggering $21,800 per month on Google Ads. Critics called it reckless, but Ken Fisher, the visionary behind the firm, saw an opportunity others missed.

This decision was just one piece of a genius marketing formula that would propel Fisher Investments to manage $236 billion in assets.

Here’s how they did it.

The Visionary Behind the Strategy: Ken Fisher

Ken Fisher is no ordinary investor. From 1984 to 2017, he wrote Forbes’ longest-running “Portfolio Strategy” column, sharing his insights with millions of readers. He’s also the author of 11 books on investing, several of which became national bestsellers. But Fisher’s true genius lies in his ability to rethink traditional marketing strategies in the wealth management industry.

While other firms relied on outdated methods, Fisher developed a revolutionary approach that would change the game forever.

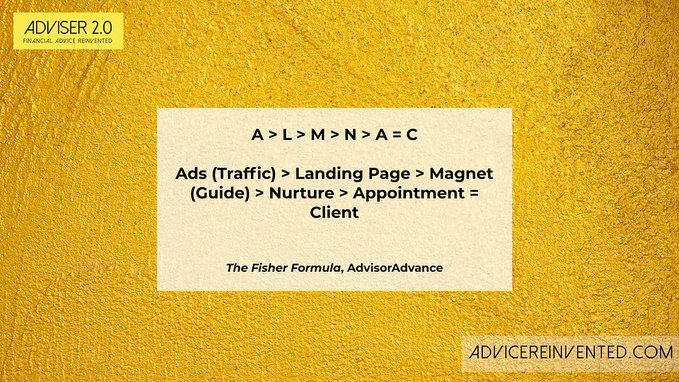

The Genius Marketing Formula: A > L > M > N > A = C

Fisher’s success can be traced back to a simple yet powerful formula:

Ads > Landing Page > Magnet > Nurture > Appointment = Client

This formula, known as A > L > M > N > A = C, became the backbone of Fisher Investments’ marketing strategy. Here’s how it worked:

- Ads: Fisher Investments invested heavily in targeted advertising, including Google Ads, Facebook, television, print, and direct mail.

- Landing Page: Each ad directed potential clients to a meticulously crafted landing page designed for conversion.

- Magnet: Instead of pushing for immediate sales, the firm offered valuable educational content, such as investment guides tailored to specific investor needs.

- Nurture: Leads were nurtured through a sophisticated system that included tailored content, rapid response to inquiries, and educational follow-ups.

- Appointment: Qualified leads were then invited to schedule appointments, turning prospects into clients.

This approach was a stark departure from the industry norm, where firms often tried to sell their services immediately. Fisher’s strategy focused on providing value first, building trust, and pre-qualifying leads to ensure they were a good fit for the firm.

Targeting the Right Audience

One of the key reasons Fisher Investments’ strategy worked so well was its laser-focused targeting. The firm specifically aimed its marketing efforts at retirees with portfolios of $500,000 or more. This pre-qualification ensured that resources weren’t wasted on unqualified leads, allowing the firm to focus on high-net-worth individuals who were most likely to become clients.

The results were transformative. By tailoring its content and messaging to this specific audience, Fisher Investments was able to build trust and demonstrate value before the first call was even made.

A Multi-Channel Approach

Fisher Investments didn’t put all its eggs in one basket. While Google Ads played a significant role, the firm diversified its marketing efforts across multiple channels, including:

- Television

- Print advertising

- Direct mail

- Email campaigns

- Online advertising

This multi-channel approach brought in massive reach. For example, the firm generated 65,000 monthly visits from Facebook alone. With an annual advertising budget of $4 million, Fisher Investments ensured its message was heard by the right people, in the right places, at the right time.

The Power of Lead Nurturing

One of the most shocking insights Fisher Investments uncovered was that 80% of new leads never translate to sales. However, companies that excel at lead nurturing generate 50% more sales-ready leads at 33% lower cost.

To address this, Fisher developed a sophisticated nurturing system that included:

- Educational content delivery

- Tailored investment guides

- Specific content for different wealth segments

- Rapid response to inquiries

This system ensured that leads were not only qualified but also well-informed and ready to engage with the firm.

The Results Speak for Themselves

Today, Fisher Investments manages $236 billion in assets and serves 40,000 clients with a team of 2,300 employees. The firm’s success is a testament to its client-first approach and its ability to innovate in an industry often resistant to change.

But the real lesson here isn’t about the size of Fisher’s marketing budget. It’s about the firm’s ability to pre-qualify prospects, build trust, and demonstrate value upfront. While other firms chase quantity over quality, Fisher Investments has mastered the art of converting high-net-worth clients consistently.

The Takeaway for Advisors

Fisher’s success offers a valuable lesson for wealth management firms and advisors:

- Focus on getting better leads, not just more leads.

- Provide value upfront through educational content.

- Tailor your messaging to specific audience segments.

- Invest in a robust lead nurturing system.

By following these principles, firms can replicate Fisher’s success and build lasting relationships with high-net-worth clients.

Ken Fisher and Fisher Investments have redefined what it means to market in the wealth management industry. Through a combination of bold advertising, targeted messaging, and a relentless focus on client value, they’ve built an empire that continues to thrive. The next time you see a Google Ad for a wealth management firm, remember: it’s not just an ad, it’s part of a carefully crafted strategy that could be worth billions.